By: Dr. Akinwumi Adesina

Urbanization is taking place in Africa at an unprecedented pace. Today, more than one quarter of the world’s 100 fastest-growing cities are in Africa.

Africa is projected to have the fastest urban growth rate in the world, at 3.2%. By 2050, Africa’s urban population is expected to double from about 600 million to 1.2 billion. What this effectively means is that Africa will be home to the largest urban population in the world.

Large cities bring enormous opportunities for growth and prosperity provided that the needed urban governance, policies, and infrastructure exist. We should consider that cities generate 55% of the total GDP of Africa. This can be expected to increase over time given that in developed economies cities generate an estimated 90% of the GDP.

Cities are fast growing consumer markets, driven largely by rapid urbanisation. Consumer expenditure in Africa has grown, reached $1.4 trillion in 2015, and is expected to reach $2.1 trillion by 2025 and 2.5 trillion by 2030.

In view of the enormous contributions of cities to overall economic growth, greater attention is needed to ensure that these economic potentials are fully maximized through better urban planning, urban governance, infrastructure, housing, health, and overall socio-economic development.

We need liveable cities. We need healthy cities. We need cities that provide decent work. We need cities that are well fed. We need secure cities. And we need cities with good quality of life.

The rapid urban growth at the early stages of Africa’s development has meant that people have been concentrating in the urban areas without the accompanying investment in infrastructure and human capital needed to reap the economic benefits.

So much of the urban expansion in Africa is characterised by unplanned and unregulated growth and high unemployment rates. For the most part of the cities jobs are concentrated in the informal sector, with more than 60% of the jobs being in the informal sector or grey economy that is neither taxed nor well monitored by governments.

Over the past 45 years, investment in infrastructure and housing in Africa has remained at around 20% of gross domestic product.

However, the chronic lack of investment in Africa has led to fragmented cities and an unsustainable model of urban growth. Additionally, unchecked urban expansion leads to increased emissions, transit costs, and the loss of natural resources and arable land that could have been used for other purposes like agriculture.

The biggest challenge facing cities in the face of massive rural-urban migration and urbanisation with rising poverty is a lack of affordable housing.

The poorly developed mortgage financing market leaves millions unable to afford decent housing. In Uganda for example, there are an estimated 5,000 mortgages for a population of 41 million people, while in Tanzania there are only 3,500 mortgages for a population of 55 million people.

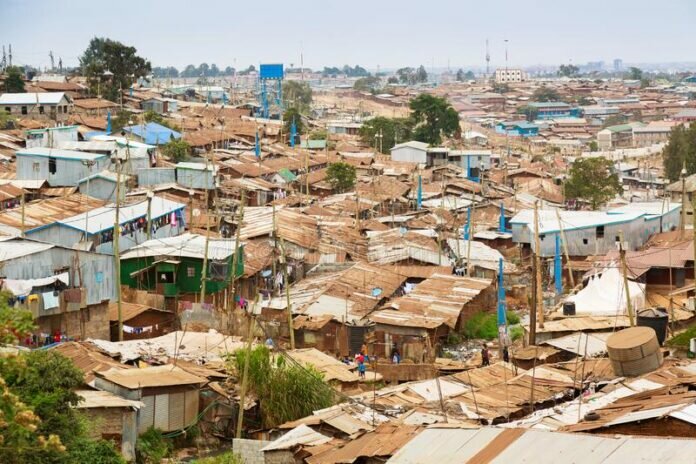

A huge challenge for many cities is the sprawling areas of slums. Two African countries, South Africa, and Kenya figure among countries with the largest slums in the world, with Khayelitsha in Cape Town and Kibera in Nairobi. Slums have unhealthy living environments, shacks, lack water and sanitation and are extremely poor communities. Because of the lack of jobs, high levels of poverty, lack of infrastructure, they are highly susceptible to violence, crime, illicit drugs, and health epidemics.

There have been several efforts to do “slum upgrading” to improve the living conditions in cities. A slum is a slum. We must not get comfortable with slums. The abnormal must not become normalized.

African cities face new challenges.

Top on the list is climate change. Africa loses $7-15 billion due to climate change, and this is projected to rise to $50 billion by 2040.

Climate change may make some cities unliveable or have such vulnerabilities and heightened risks that will reduce their attractiveness for investors. It is, therefore, critically important that cities develop disaster risk management strategies, build city resilience frameworks and climate adaptation plans.

There is no doubt that much still needs to be done to make our cities better. A key area that we must tackle is how to support cities and towns to have greater access to financing, as well as greater autonomy in the management of their financing.

The African Development Bank’s Boards of Directors approved in 2018 a new non-sovereign operations policy that allows the Bank to lend to decentralised entities such as cities, towns, and local governments. The Bank has also recently established an Urban Development Division to support sector operations and to build knowledge on urban development in Africa.

The African Development Bank also established in 2019 the Urban and Municipal Development Fund, to enhance the provision of technical assistance and capacity building for integrated urban planning, governance, project preparation, and broader urban management, including municipal fiscal management. The Fund is now providing support in more than 15 cities.

By promoting housing as an important asset class, supporting securitization and mortgage-backed securities will be attractive to asset managers and private sector. Greater efforts are needed to develop local financial markets, use of green bonds to support housing, provide technical assistance to financial institutions, and providing greater access to housing finance for women and youth.

There is need to provide greater autonomy and fiscal responsibility to cities and towns and for national governments to allow them to raise financing to meet the huge needs of development. Instead of simply depending more on transfers from national governments, cities and towns should build their institutional capacity to raise their own financing.

Aside from the regular sources such as local taxes and levies, they should be strengthened and provided regulatory space to raise financing on local capital markets by posting municipal and green bonds. This is especially important as studies have shown that debt by subnational entities account for only 4% of total debt of countries in Africa.

A study by the UCLG of 153 cities in Africa found that just 6.5% of the cities have access to credit. This must change. There cannot be sustainable development of cities without access to low cost and long-term sustainable financing for cities.

We must achieve the Africa we want. The Africa we want must be one where our cities are well planned to become drivers of greater economic growth and prosperity for Africa. This cannot happen by chance. The future is not created by a roll of the dice. The more we delay actions to transform our cities, the greater the costs to Africa’s development. The cost of inaction to develop better cities is higher than the cost of action. So let us act to transform Africa’s cities.

Editor’s note: a heavily edited Keynote Speech Delivered by Dr. Akinwumi A. Adesina, President, African Development Bank Group, at the launch of the African Mayoral Leadership Initiative (AMALI), 23 January 2023