The shilling traded flat amid low demand for dollars as most market players remained on the fence awaiting fresh clues from the budget pronouncements. On the other hand BOU maintained the CBR rate at 10 percent citing uncertainty in the economic outlook.

In Kenya, the currency continued to slide undermined by increased demand from energy and manufacturing sectors. The unit was quoted at 139.2.

In the fixed income market, there was overwhelming demand in the bond market, as players scrambled to take up 400 billion on offer split between 3 and 15 year bond issues . Market expectations were that the issuer will let rates increase as government attempts to meet its obligations before the closure of the fiscal year. Yields held at 14% and 16% respectively. The BoU took up 642 billion

In the global markets, the dollar held up following the pause by the Federal reserve of its aggressive rate hikes despite elevated inflation. The Fed however indicated that another sharp increase could be on the cards in the coming months.

”Going forward, the shilling is seen clinging to its gains as demand is expected to remain at a low ebb as markets digest what is seen as an optimistic budget aimed at returning the economy on the pre- pandemic path to growth.” said Stephen Kaboyo, the Alpha Capital Markets boss

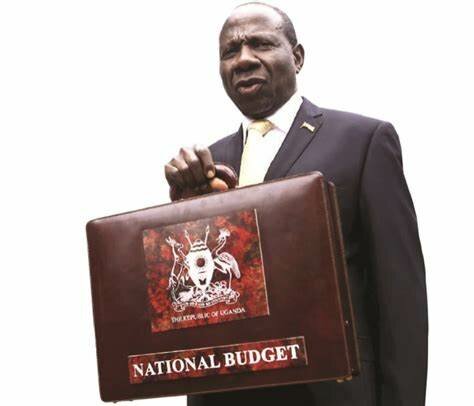

Finance minister Matia Kasaija said the government is focusing on improving revenue collections as well as cutting public expenditure. The theme of the 2023/2024 budget is “Full Monetisation of Uganda’s economy through Commercial Agriculture, Industrialisation, Expanding and Broadening Services, Digital Transformation and Market Access.”

Among the measures, the government says it will not purchase new vehicles except for revenue mobilisation, security operations and agricultural activities. It also plans to limit foreign travel to a few officials, as well as rationalising the tax exemption policies to reduce revenue lost in these incentives. But such talk like in previous budget normally only remains on paper.

Kasaija says the targeted revenue collections this year are part of the efforts to increase revenue collection levels to at least 14 per cent next year and further increase it to between 16 and 18 per cent.

Minister Kasaija said the government has put in place several measures that will ensure not only better revenue collections but also enhance government spending discipline. He said the government is also cautious about borrowing domestically to avoid suffocating the local private sector that relies on local loans.

This, he said will be done amidst reduced borrowing on commercial and non-concessionary loans, which are expensive. He says such loans will only be limited to projects with high economic returns.

On the mismanagement of public expenditure by officials, Kasaija said there are measures that have been put in place to ensure the smooth running of government projects.

These will include negotiations with lenders on the smooth implementation of funded projects and ensuring that before a project is approved for funding, there should be selection, design, approval and analysis made before approval for funding.

He also revealed the creation of a land acquisition fund that will address delays in compensation. The increased public borrowing amidst public expenditure is a pressure on the economy. We want to request that we reduce on public borrowing.

The high unit cost of implementing the infrastructure projects notably in sustainable energy development and integrated transport infrastructure and service programs is mainly attributed to over-dependence on foreign entities and supervised by foreign persons who are paid highly instead of making sure that our local content is encouraged and given work to be done. Continued accumulation of domestic arrears in a disruptive effect of performance of the private sector,” said Kasaija.

Alpha Capital Forex Bureau: For competitive Forex Rates VISIT Plot 12 KAMPALA ROAD-CHAM TOWERS SUITE 43: call:

also read: